Enjoyed the video?

Help us improve! Leave feedback on your experience.

Breaking: $100 Silver in Sight as Market Manipulation Unravels

Silver is approaching a critical inflection point—and the battle you’re watching on the chart may be the final phase of a decades-long price control era. In this episode, we break down why repeated paper sell-offs are losing effectiveness, how physical demand is tightening the market’s real supply chain, and why the shift from Western paper pricing to Eastern physical influence could redefine “price discovery” in precious metals.

We also address the growing wave of AI-driven misinformation and deepfake-style posts circulating online—why they’re spreading now, how to verify what’s real, and what market participants should focus on instead. Finally, we outline the practical risks and opportunities that come with a potential breakout environment—where volatility rises, credibility gets tested, and supply constraints become impossible to ignore.

Chapters

00:00 — What just happened (and why it matters now)

01:18 — Why paper smashes are failing faster

03:42 — The real driver: physical tightness vs. paper supply

06:30 — East vs. West: where price discovery is shifting

09:05 — The $100 silver question: what breaks first?

12:10 — Short pressure, positioning stress, and “panic buying” dynamics

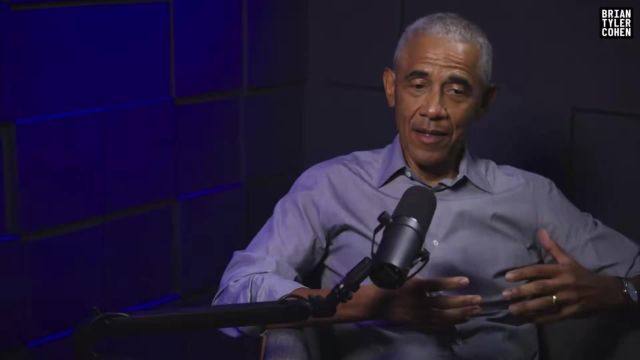

15:20 — Deepfakes & viral misinformation: how to spot the traps

18:40 — What exchanges/regulators can do—and what they can’t

22:05 — Real-world impact: availability, premiums, and the retail squeeze

25:30 — Practical positioning: physical, risk, and volatility discipline

28:10 — Final takeaway + audience questions

#silver #preciousmetals #gold #comex #lbma #marketmanipulation #inflation #investing #macro #bullmarket #pricediscovery #physicalsilver #wealthpreservation

0 Yorumlar